tax benefits of retiring in nevada

Considering the national average is 100 retirement here is going to cost more than some other states. Tax benefits of retiring in nevada Thursday August 4 2022 Nevada offers an abundance of tax advantages for relocating home and business owners alike including.

How To Plan For Taxes In Retirement Goodlife Home Loans

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

. States That Don T Tax Retirement Income Personal Capital. We dont make judgments or prescribe specific policies. Its also important to note that Nevadas sales tax is significantly less than Californias.

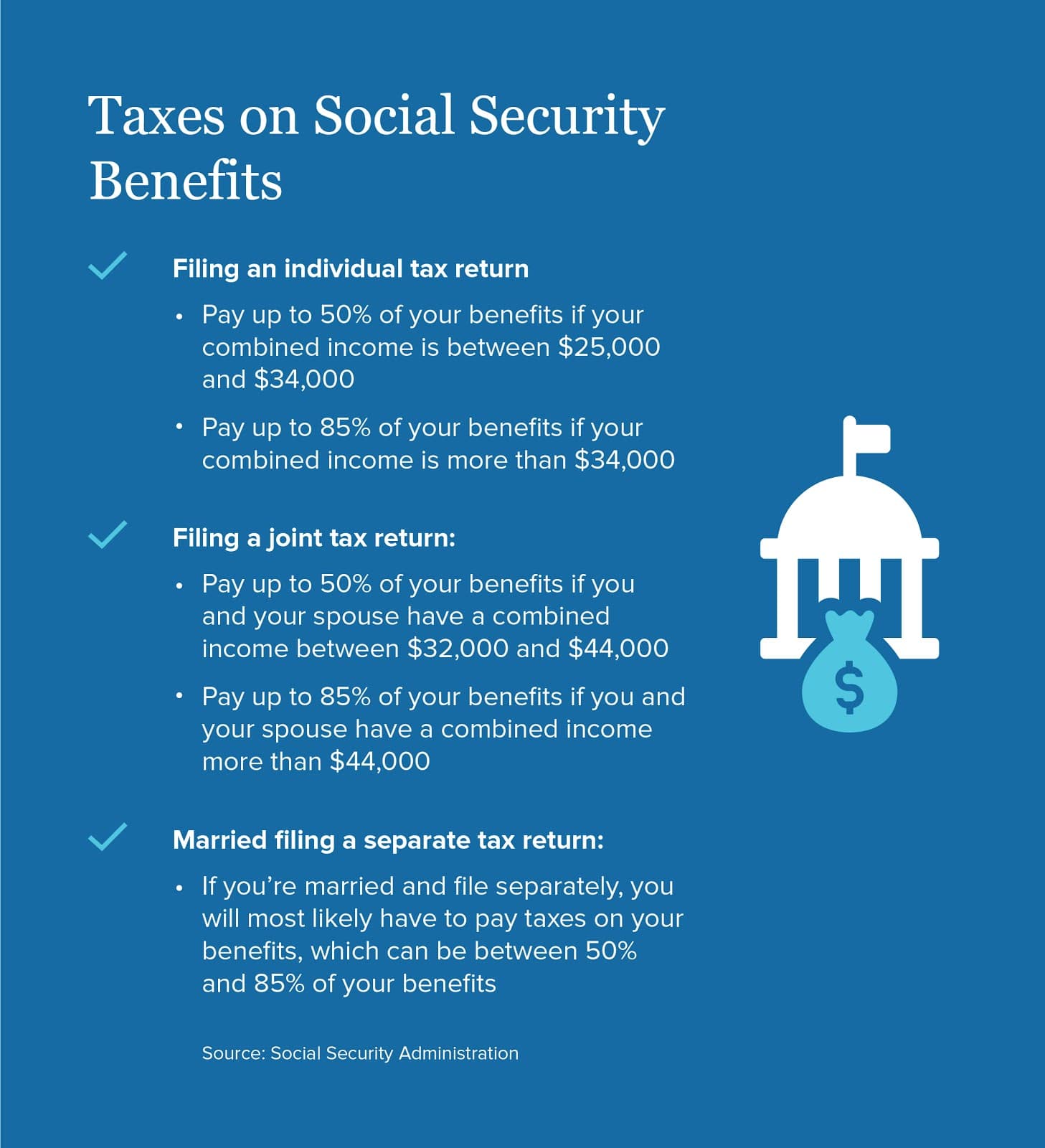

Additionally Social Security income is not taxed as well as withdrawals from retirement accounts. Get Personalized Action Items of What Your Financial Future Might Look Like. Residents of Nevada are not assessed a state income tax.

Las Vegas has many many over 55 housing areas. 10 Nevada Tax Benefits. The contribution rate for Policefire.

320189 SHARE OF POPULATION 65. Ad If you think theres no such thing as a happy retirement think again. Simply just multiply the property tax rate by the your assessed value 032782 district tax rate x 87500 your assessed value 2868425.

Retiring in Reno Nevada gives you access to gambling as well as activities like skiing golfing or just hanging out on Lake Tahoe. Increased the exemption on income from the state teachers retirement system from 25 to 50. No personal income tax No corporate income tax No gross receipts tax No franchise tax No inventory tax No tax on issuance of corporate shares No requirements of shareholders directors to live in Nevada No tax on sale or transfer of shares.

People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. Residents of Nevada are not assessed a state income tax. When you retire you want to live where your money will last longer.

What are the pros and cons of retiring in Nevada. 194 COST OF LIVING FOR RETIREES. No Corporate Income Tax.

However prescription medications and consumable grocery items are exempt. No gross receipts tax. No tax on social security.

No tax on estate or inheritance. Specific Nevada Tax Benefits. No Nevada Inheritance Tax after 3 years of residency.

You know you want to. We pay no state income tax. Theres No Corporate Income.

The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies. For taxed items the sales tax rate sits at 46 plus local taxes which can reach a total of 8265 at the highest. Nevadas tax benefits are great for families businesses and retirees.

10 above the national average PER CAPITA INCOME FOR POPULATION. Zero No Nevada State Income Tax. Make the most of these top retirement nests all across the US.

Nevada offers an abundance of tax advantages for relocating home and business owners alike including. Tax benefits of retiring in nevada Saturday June 11 2022 Edit. Under the EmployeeEmployer Paid contribution plan the employee and the employer share equally in the contribution to PERS which is currently 1450 of gross salary each for regular members.

This includes any income from a pension 401k IRA or any other retirement account. Meals are reasonable and the food is delicious. 33238 TAX RATING FOR RETIREES.

There are also significant tax exemptions created just for seniors including prescriptions and medical equipment as well as. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Considering the national average is 100 retirement here is going to cost more than some other states.

Our yearly rainfall is a little over 3 inches. The Silver State doesnt tax pension incomes and any other income because it doesnt have an income tax. The biggest benefit for retirees seeking a home in Nevada is perhaps the income-tax-friendly policies.

Our Resources Can Help You Decide Between Taxable Vs. Nevada does not tax retirees accounts pensions or social security. The current state sales tax is 685 percent with an additional 125 percent assessed by counties.

The EPC contribution rate for regular members is 2800 of gross salary and the rate for policefire members is 4050 of gross salary. The current state sales tax is 685 percent with an additional 125 percent assessed by counties. Ad Get this guide and learn 7 investing strategies to help you generate retirement income.

Fisher Investments shares these 7 retirement income strategies to help you in retirement. According to Sperlings Best Places the cost of living index in Nevada is 102. Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

No tax on pensions. See what makes us different.

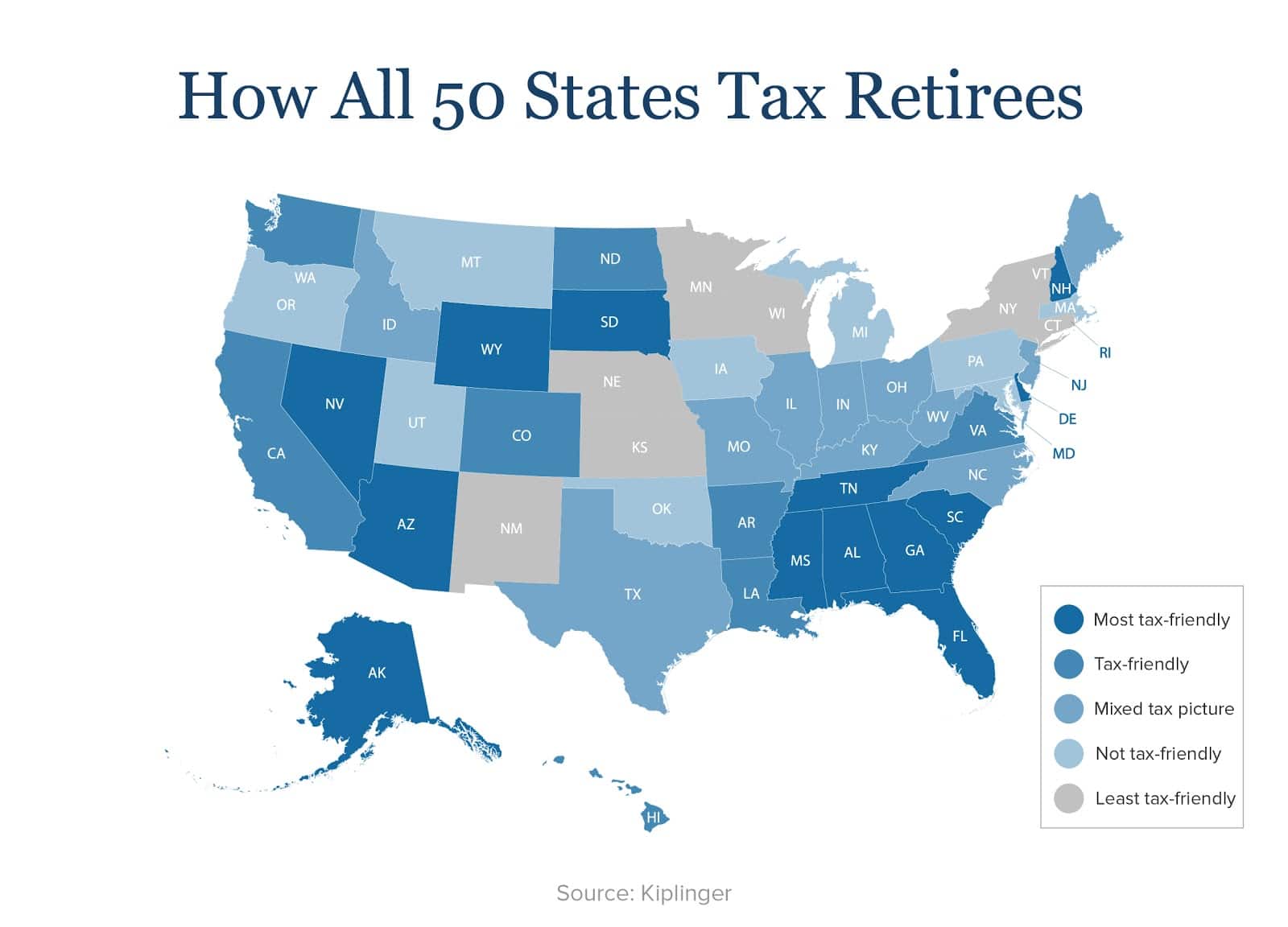

States That Don T Tax Retirement Income Personal Capital

How To Plan For Taxes In Retirement Goodlife Home Loans

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Choosing A Retirement Destination Tax Considerations Lvbw

37 States That Don T Tax Social Security Benefits The Motley Fool

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Nevada Tax Advantages And Benefits Retirebetternow Com

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

37 States That Don T Tax Social Security Benefits The Motley Fool

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement

Best Hot New Restaurants In Las Vegas Nv Las Vegas Las Vegas Hotels Momofuku

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)